- Gas prices in the USA are expected to rise by 3–5% in April, reflecting broader market trends.

- Crude oil prices remain high, consistently trading above $70 per barrel, directly impacting gasoline costs.

- Seasonal travel and increased demand during the travel season contribute to upward pressure on prices.

- Supply chain issues, refining challenges, and tightening inventories are leading to localized shortages and higher costs.

As we move into the fourth month of 2025, the ongoing trends indicate that Americans may soon feel the unwanted pinch at the pump. On Wednesday (02 April, 2025) gasoline prices touched their highest level since September 2024.

As per GasBuddy extensive data, based on more than 12 million individual price reports from over 150,000 gas stations across all US states, there has been a hike in price for straight two weeks. This week the price escalated by 2.7 cents and now stands at $3.26 per gallon. As per the available data and analysis from industry experts, the month of April could bring even higher gas prices throughout the country.

In this blog post, we will explore the factors driving this increase, which has become a major issue of concern not only for the people but government as well, ongoing oil prices and market conditions, and discuss how you can prepare for the change—all backed by multiple industry insights.

Current Trends and Data

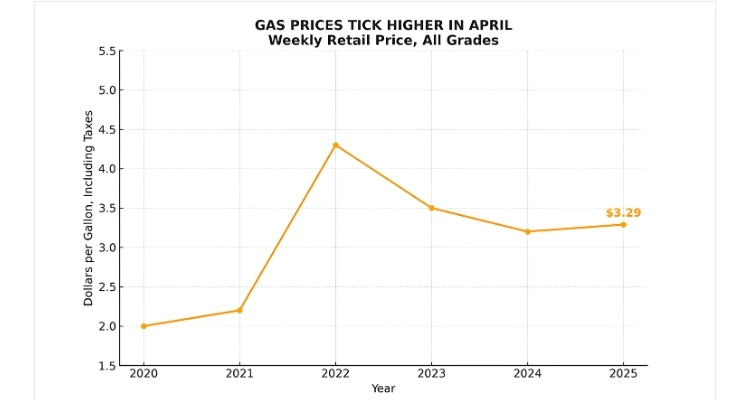

The recent reports from the U.S Energy Information Administration (EIA) and other industry analysts reveals that the rise in gasoline prices is not an overnight occurrence. It has been climbing steadily over the past few months. The graph below based on these reports clearly shows how gas prices are bound to escalate.

For example, according to the latest EIA Short-Term Energy Outlook, the national average price for regular gasoline was around $3.75 per gallon as of early March 2025. However, the forecasts suggest an additional increase of about 3-5% in April, potentially pushing the fuel prices closer to $3.90 per gallon.

Additionally, gas prices have reached their highest levels since last September, primarily due to oil prices consistently trading above $70 per barrel. According to AAA data, the national average price for gasoline hovered near $3.24, which is $0.14 higher than a month ago but $.029 lower than at the same time one year ago.

Overall, this sustained high oil price environment directly translates to increased fuel costs at the pump. So, if your ride has limited efficiency, it may get expensive for you. You can start handling the situation by following the manufacturer’s recommended car maintenance schedule and look for alternatives (if possible).

Oil Prices and Market Conditions

The recent market developments have played a key role in shaping the current energy landscape and hike crisis in America. From geopolitics to President Trump’s new tariffs, everything has one way or another aided this new problem added to the consumer’s list.

Geopolitical and Tariff Influences

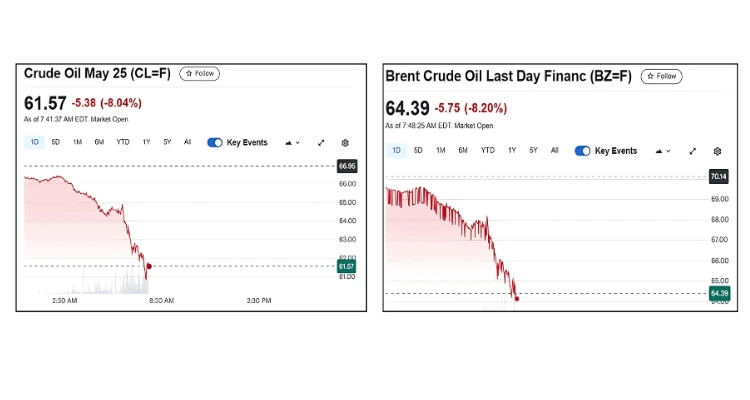

With the government’s commitments to potentially impose secondary tariffs on Russian oil in the midst of the stalled ceasefire negotiations, oil prices already saw a slight uptick.

As of early trading, West Texas Intermediate crude (WTI crude) was up 21 cents at $69.57 per barrel (up from $68.62 a week ago), while Brent crude increased by 50 cents to $74.13 per barrel (up from $72.51 per barrel).

These moves are ongoing despite the looming concerns over a developing trade war and new sanctions on Iran, Venezuela, and potentially Russia, which have helped keep oil prices from declining more sharply.

Inventory and Refining Data

The EIA’s Weekly Petroleum Status Report for the week ending March 21, 2025, shows that U.S. oil inventories fell to their lowest level since December by 3.3 million barrels, which is about 5% below the seasonal average. Meanwhile, the Strategic Petroleum Reserve (SPR) increased by 300,000 barrels to 396.1 million barrels.

Gasoline inventories dropped by 1.4 million barrels, standing 2% above the five-year seasonal average, while distillate inventories fell by 400,000 barrels, approximately 7% below the seasonal norm.

Refinery utilization increased slightly to 87.0%, even as ongoing maintenance continues to affect operations.

Implied gasoline demand (the EIA’s proxy for retail demand) fell modestly by 174,000 barrels per day to 8.643 million barrels per day, indicating a relatively soft level of consumption.

All these factors underline the current tightness in the market and suggest that continued high demand paired with constrained supply will likely keep upward pressure on fuel prices.

Related Post: Ram Drops Extended Range 1500 REV and Everyone Is Talking

Price Fluctuation Trends

If you want to know more about the ongoing chaos related to gasoline, understanding the fluctuations in prices can provide you valuable context for current trends.

As per different online resources, including government ones, the gasoline prices have experienced temporary dips down to around $3.50 per gallon during the low-demand periods only to rebound back as the travel season in the country commences and crude prices surge.

Seasonal demand combined with supply chain constraints and inventory adjustments has also contributed to these fluctuations. The brief price dips surely offer temporary relief, but the overall trend indicates a steady rise as inventories tighten and refineries encounter operational challenges.

Key Data Points:

- Early March: Prices stabilized around $3.75 per gallon.

- Recent Peaks: Some US regions have seen spikes approaching $3.90 per gallon due to sudden supply shortages and increased travel demand.

- Ripple Effects: Minor shifts in crude oil prices, hovering near $70 per barrel, tend to create significant ripples throughout the supply chain, ultimately impacting the final price at the pump.

Detailed Gasoline and Diesel Price Trends

Both diesel and gasoline prices are being affected by local market conditions, inventory levels, broader geopolitical and economic factors, and the new Government’s different policies that aim to help the domestic industry.

When compared to each other, the price trends for both these fuels are quite different from one another. So, if you own a Plug-in hybrid, hybrid, or a regular fuel-dependent ride, knowing these trends can help you plan your trips and expenses better.

Gasoline Price Trends

Most Common Prices: The most frequently encountered gasoline price is $2.99 per gallon, followed by $2.89, $3.09, $2.79, and $3.19 per gallon.

Median vs. Average: The median U.S. gas price is $2.99 per gallon, which is 3 cents higher than last week, though it remains about 12 cents lower than the national average.

Regional Variations:

- Lowest Prices: Oklahoma ($2.64), Mississippi ($2.66), Tennessee ($2.70).

- Highest Prices: California ($4.71), Hawaii ($4.41), Washington ($4.10).

Weekly Changes: Notable weekly increases include Maryland (+14.9¢), California (+12.4¢), Florida (+11.6¢), South Dakota (+11.6¢), and Kentucky (+11.1¢).

Diesel Price Trends

Most Common Prices: The most common diesel price stands at $3.49 per gallon, followed by $3.59, $3.29, $3.69, and $3.39 per gallon.

Median vs. Average: The median diesel price is $3.49 per gallon, which is 4 cents up from last week, yet it remains about 7 cents lower than the national average.

Regional Variations:

- Lowest Prices: Texas ($3.10), Oklahoma ($3.11), Louisiana ($3.19).

- Highest Prices: Hawaii ($5.22), California ($4.95), Washington ($4.38).

Weekly Changes: The most significant weekly increases for diesel have been seen in Iowa (+11.5¢), South Dakota (+10.6¢), Delaware (+7.8¢), Maryland (+5.9¢), and North Carolina (+5.8¢).

What’s Fueling the Price Increase?

There are multiple factors that contribute to the expected price hike of diesel and gasoline this coming April:

Rising Crude Oil Costs

Global supply constraints, heightened geopolitical tensions, and recent tariff-related measures have pushed crude oil prices upward. With oil consistently trading above $70 per barrel, the cost to produce gasoline has risen accordingly.

Seasonal Demand and Travel Trends

As warmer weather approaches and travel picks up with young college students and families out for exploration and good times, gasoline demand increases. April is traditionally when drivers begin refueling in anticipation of the summer travel season, tightening supply further.

Supply Chain and Refining Challenges

Bottlenecks in refining capacity and distribution networks, along with declining gasoline and distillate inventories, add another layer of pressure on fuel prices.

Market Dynamics

Ongoing adjustments in oil inventories and the behavior of major market players, combined with tariff and sanction-related news, continue to shape the energy landscape and influence fuel costs in the USA.

Impact Of Hike On Consumers And The Economy

For everyday drivers, even a minute increase in gasoline prices can disbalance their household budgets. This becomes even a much bigger concern for those who cover long travels on a daily basis or rely heavily on their vehicles. The increased fuel costs that are anticipated to rise more may lead to:

- Higher Transportation Expenses: With each gallon costing more, drivers will face higher daily expenses, reducing their disposable income for other needs.

- Broader Inflationary Pressures: The rising transportation costs can contribute to overall inflation, as the cost to move goods will also increase.

- Behavioral Shifts: Consumers might be prompted to consider alternative transportation options, such as carpooling, public transit, or more fuel-efficient vehicles, to handle the impact of rising fuel costs.

What to Expect in April 2025

Industry experts predict that April will continue the escalating trend in gasoline prices. With seasonal travel and persistent global oil price pressures, all drivers and car owners should prepare for the following:

Short-Term Price Volatility

Expect fluctuations, particularly in regions where supply constraints and local refining capacities are more pronounced.

Regional Variations

Urban areas with competitive fuel markets or a high number of tourists might see a more tempered increase compared to rural or remote regions facing more significant supply issues.

Market and Policy Responses

Government initiatives aimed at stabilizing fuel costs, along with strategic adjustments from the refining and distribution sectors, may help moderate the price hikes over time.

Tips For Gasoline Car Drivers

Concerning the ongoing fuel prices clash, you need to understand that there are several influencing factors which are beyond your control. However, the good news is that there are some strategies that you can adopt to manage the impact of this ongoing crisis:

- Plan Your Trips: If you are determined to take a trip this month, do not go for spur-of-the-moment things. Explore the local fuel prices and aim to fill up during off-peak hours or when prices dip.

- Consider Alternative Transportation: Who says you can go on a road trip only on your private ride? Amid the rising fuel prices, explore options like carpooling, public transit, or even cycling to reduce reliance on personal vehicles and save on fuel.

- Explore Fuel-Efficient Options: If you are out in the market to get a new car, consider fuel-efficient, hybrid, or electric models. Do in-depth research to shortlist the models that can offer long-term savings despite higher fuel costs.

Conclusion

For 2025, April’s forecast of rising gas prices in the USA serves as a reminder of how our everyday economy is interconnected with the nature of the global energy markets. With crude oil prices remaining high, seasonal demand intensifying, and recent market adjustments contributing to tighter inventories and supply chain challenges, you should expect and prepare for higher costs at the pump.

If you wish to navigate through these ongoing changes in an effective way, stay informed through reliable industry insights and keep monitoring the latest data from trusted sources. By planning and considering cost-saving strategies, you can handle the financial impact and manage your transportation budget well during these dynamic times.